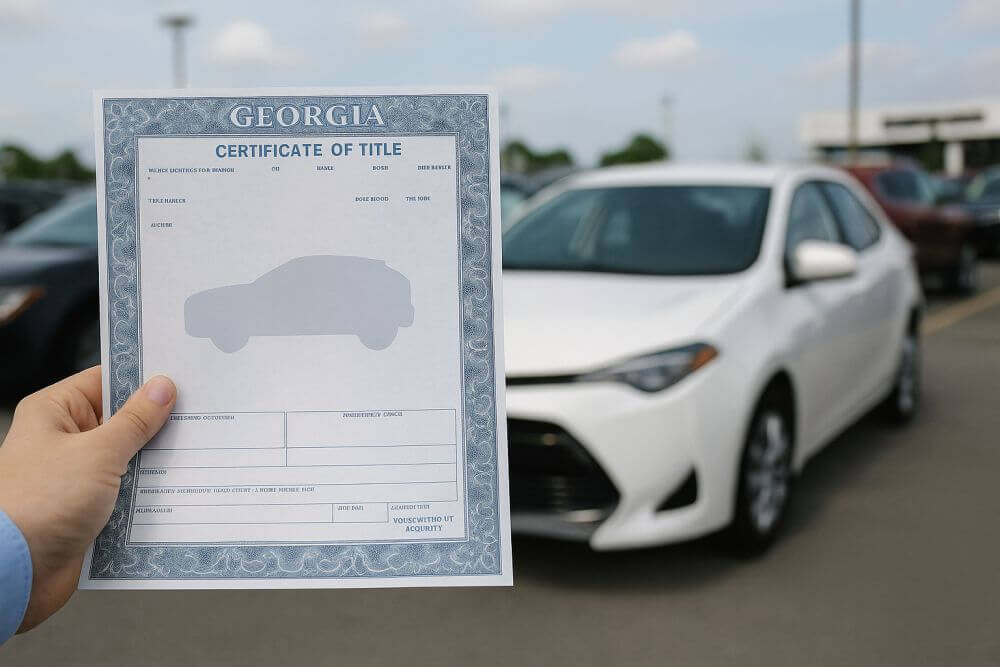

When you’re buying a used car, there’s one silent deal-breaker that can cost you thousands — and it’s not visible on the dashboard or under the hood. It’s an active lien on the vehicle title.

A car lien means someone (usually a bank or lender) still has legal ownership of the vehicle until a loan is paid off. And if you buy a car without realizing it has a lien, you could end up stuck with someone else’s debt — or worse, lose the car altogether through repossession.

But here’s the good news: you don’t have to call the bank or hunt down the seller’s financing paperwork to get the truth. With the right tools and a little know-how, you can check for a car lien yourself — safely, quickly, and for free.

What Is a Car Lien and Why Should You Care?

A vehicle lien is a legal right granted to a lender or creditor that allows them to claim ownership of the vehicle until the loan is paid off in full. It’s a way for the lender to protect themselves from financial loss.

Common reasons a car might have a lien:

- The owner financed the car and hasn’t paid off the loan yet

- A repair shop or towing company placed a mechanic’s lien for unpaid services

- A court judgment resulted in a lien against the vehicle

If you unknowingly purchase a car with an active lien, you don’t just inherit the car — you may inherit the financial obligation too. Worse, the lender can legally repossess the vehicle from you, leaving you without the car or your money.

Signs a Car Might Have a Lien

There are red flags you can watch for when evaluating a used vehicle:

- The seller has no title or only a copy

- The title says “Lienholder” or shows a bank name

- The price seems suspiciously low

- The seller pushes for a fast cash-only deal

- The vehicle came from an auction, tow yard, or salvage seller

Even if none of these apply, always assume there could be a lien until you verify it yourself.

How to Check for a Lien — Without Calling a Bank

You don’t need to call lenders, fax documents, or dig through county courthouse records. Here’s how you can check for a lien online, step-by-step:

1. Get the Vehicle’s VIN or License Plate Number

To begin your lien check, you’ll need one of the following:

- VIN (Vehicle Identification Number) — usually found on the driver’s side dashboard, inside the door frame, or on the title/registration

- License Plate Number + State — works if you can’t find the VIN

Make sure the information matches what’s listed on the title or registration documents.

2. Run a Quick Vehicle Lien Check Using Our Free Online Tool

VinCheckPro.com offers a free vehicle lien check that pulls real-time data from state DMV systems and the National Motor Vehicle Title Information System (NMVTIS).

👉 Run a quick vehicle lien check using our free online tool

What you’ll get:

- Lien status (active, released, or none)

- Title history (clean, salvage, rebuilt, junk, etc.)

- Odometer readings and rollback alerts

- Ownership transfers

- Theft, flood, or total loss records

This tool works 24/7 and doesn’t require you to call a bank, visit a DMV office, or pay for access.

3. Verify Title and Lien Release Documentation

If your report shows an active lien, proceed with caution. Ask the seller:

- If the lien has been paid in full

- If they have a lien release letter from the lender

- If the title is in their name and lien-free

Without a lien release, the vehicle is still legally owned (in part or whole) by the creditor — and you should not proceed with the sale.

What NOT to Do

When checking for liens, avoid these common mistakes:

- Don’t rely on the seller’s word alone. Even well-meaning sellers might not know the lien is still on file.

- Don’t assume a clean title means no lien. A title can say “clean” and still have a lienholder listed.

- Don’t skip the lien check just because the car is cheap. Low prices often mask major red flags.

What a Vehicle History Report Tells You (Beyond Liens)

A quality lien check tool will give you more than just lien info. You’ll also get:

| 📋 Section | 🔍 What You’ll Learn |

|---|---|

| Title Brands | If the car has ever been marked salvage, rebuilt, flood, or junk |

| Odometer History | Check for rollback attempts or inconsistencies |

| Accident Records | Damage reports, total loss declarations, and repair history |

| Theft Check | Whether the vehicle is stolen or flagged in recovery databases |

| Owner History | How many times the title changed hands and in what states |

All of this can help you negotiate better, walk away from shady deals, or confidently close a purchase knowing you’re protected.

Pro Tips for Used Car Buyers

If you want to stay in control of your car-buying experience and avoid hidden liabilities:

- Always run a lien check — even for private sales or Craigslist deals

- Don’t sign anything until the lien is cleared

- Use licensed escrow or payment services for high-value transactions

- Request a written lien release and verify it with your DMV before registering the car

Example Scenario: What Can Go Wrong Without a Lien Check?

Imagine buying a used SUV from a private seller. Everything seems fine. You pay in cash, get a bill of sale, and drive off. A few weeks later, you receive a notice from a lender: the car was financed and still has $6,800 left on the loan.

Because you never checked the lien status, the bank now has the legal right to repossess the vehicle. Your money is gone — and so is your SUV.

All of this could have been avoided with a 30-second free lien check.

Final Thoughts: Don’t Skip the Lien Check

A vehicle might look perfect on the outside, but the title could carry invisible baggage. Don’t leave it up to chance — or a seller’s memory. In today’s digital world, you can protect yourself with a free, fast lien check using nothing more than a VIN or license plate number.

Frequently Asked Questions

Can I check if a car has a lien without contacting the lender?

Yes. You can use a free online tool like VinCheckPro to search national title databases using the VIN or license plate — no need to call the bank.

What happens if I buy a car with an active lien?

If the lien hasn’t been released, the lender still legally owns part of the car and can repossess it. You may also be responsible for the previous owner’s unpaid loan.

Does a clean title mean the vehicle is lien-free?

Not necessarily. A clean title means no salvage or branding, but it may still have a lienholder listed if the loan isn’t paid off.

Is it legal to sell a car with a lien?

Yes, but only if the seller discloses the lien and arranges for payoff and title transfer through the lender. Always verify lien status before handing over payment.

Can I use a license plate instead of a VIN to check for liens?

Yes. VinCheckPro allows users to run lien checks using a plate number and state, which is helpful when the VIN isn’t easily available.

Run Your Free Vehicle Lien Check Now

Ready to protect your money and peace of mind?

👉 Run a quick vehicle lien check using our free online tool

No phone calls. No paperwork. No risk.