Buying a used car can be a smart financial decision—if you know its full history. One of the biggest red flags you can uncover during research is a salvage title. A salvage title means the vehicle has been declared a total loss by an insurance company, often due to severe accident damage, flooding, fire, or theft recovery.

Purchasing a salvage vehicle without understanding its past can lead to safety hazards, hidden repair costs, limited insurance coverage, and poor resale value. This is why checking for a salvage title before you buy is absolutely essential.

The good news? You can uncover a salvage title for free using online VIN lookup tools, state resources, and federal databases. In this guide, you’ll learn exactly what a salvage title is, why it matters, and step-by-step instructions for running a free salvage title VIN check—including using a car history report or Free Carfax Report alternative from VinCheckPro to get detailed title and accident records instantly.

What Is a Salvage Title?

A salvage title is an official designation given to a vehicle that has sustained so much damage that the cost of repairing it exceeds a significant percentage of its pre-damage market value—usually between 60% and 90%, depending on the state. Once declared a total loss, the insurance company notifies the DMV, and the car is issued a salvage-branded title.

Common Reasons for a Salvage Title

- Severe Accidents – Cars involved in high-impact collisions that result in bent frames, destroyed crumple zones, or damaged safety systems.

- Flood Damage – Vehicles submerged in water or exposed to heavy flooding, often leading to electrical corrosion and engine issues.

- Fire Damage – Cars affected by engine fires, wildfires, or interior fires that compromise structural and mechanical integrity.

- Theft Recovery – Stolen vehicles recovered with significant parts missing, vandalism, or stripped interiors.

Example: If a $15,000 sedan suffers $10,000 in damage during a crash, repairing it might not be economically viable for the insurer. Even if it’s fixed later, the salvage title remains permanently.

Why a Salvage Title Should Matter to You

While a salvage car might seem like a bargain, the hidden risks can outweigh the savings.

The Major Risks:

- 🚨 Reduced Resale Value – Salvage vehicles typically sell for 30–50% less than clean-title equivalents.

- 🚨 Hidden Structural Damage – Repairs may cover up frame misalignment, poor welds, or non-OEM replacement parts.

- 🚨 Insurance & Financing Issues – Many insurance companies refuse comprehensive coverage, and banks often won’t approve loans for salvage vehicles.

- 🚨 Potential Title Fraud (Title Washing) – Dishonest sellers re-register salvage vehicles in another state to obtain a clean title and hide the car’s history.

According to the National Highway Traffic Safety Administration (NHTSA), flood-damaged vehicles are especially prone to title washing, making VIN checks critical.

How to Spot a Salvage Title Before You Buy

Fortunately, there are multiple ways to uncover salvage status—many of them free or low-cost. Here’s a step-by-step process:

1. Use a Free Carfax Alternative Like VinCheckPro

VinCheckPro offers a Free Carfax Report alternative that reveals:

- Salvage, rebuilt, or total loss history.

- Detailed title changes and accident reports.

- Flood, fire, or theft branding.

This tool uses multiple national and state data sources to provide a more complete snapshot than many single-source lookups.

2. Check the National Motor Vehicle Title Information System (NMVTIS)

NMVTIS is a government-mandated database that compiles title data from state DMVs, salvage yards, and insurance carriers.

- It helps detect title washing by revealing all brands ever applied to a VIN.

- Some NMVTIS-approved providers offer free or inexpensive reports.

3. Perform a State DMV Title Search

Most state DMVs allow you to request a title history online or in person.

- Costs: Some states provide this service for free; others charge $2–$15.

- Benefit: Confirms if the salvage title was issued in your state, even if other databases miss it.

4. Physically Inspect the Vehicle for Clues

Even if the title looks clean, the car may have salvage-level damage that wasn’t reported to insurance. Look for:

- Frame Issues – Uneven panel gaps, doors or trunk not closing smoothly.

- Flood Indicators – Musty odor, rust in unusual places (seat tracks, wiring harnesses), water lines inside lights.

- Shoddy Repairs – Overspray paint on trim, mismatched body panels, visible weld seams.

5. Check Insurance & Warranty Eligibility

Before purchase:

- Ask your insurance provider if they will insure the vehicle and at what coverage level.

- Check the manufacturer’s warranty policy—most exclude salvage-branded vehicles entirely.

How to Avoid Salvage Title Scams

Scammers know that many buyers don’t check title histories carefully. Avoid these pitfalls:

- Title Washing – Moving a salvage-titled car to another state to obtain a clean title. NMVTIS checks can help catch this.

- Fake Title Transfers – Seller’s name doesn’t match the title, indicating a possible curbstoner (unlicensed dealer).

- Unreported Damage – Not all damage results in an insurance claim. Always combine a VIN check with a physical inspection.

How to Run a Free VIN Check for a Salvage Title – Step-by-Step

1️⃣ Locate the VIN – Find it on the dashboard (driver’s side), inside the driver’s door frame, or on official documents like the title or registration.

2️⃣ Enter the VIN in a Trusted Tool – Use VinCheckPro for a Free Carfax Report alternative or NMVTIS for government-verified data.

3️⃣ Review for Salvage or Rebuilt Branding – Look for “Salvage,” “Flood,” “Fire,” or “Total Loss” indicators.

4️⃣ Cross-Check Multiple Sources – Confirm results with your state DMV’s title history request.

5️⃣ Inspect in Person – Always verify that the vehicle’s condition matches its documented history.

✅ Pro Tip: A car history report from VinCheckPro will combine title branding, accident history, and odometer readings into one report for faster review.

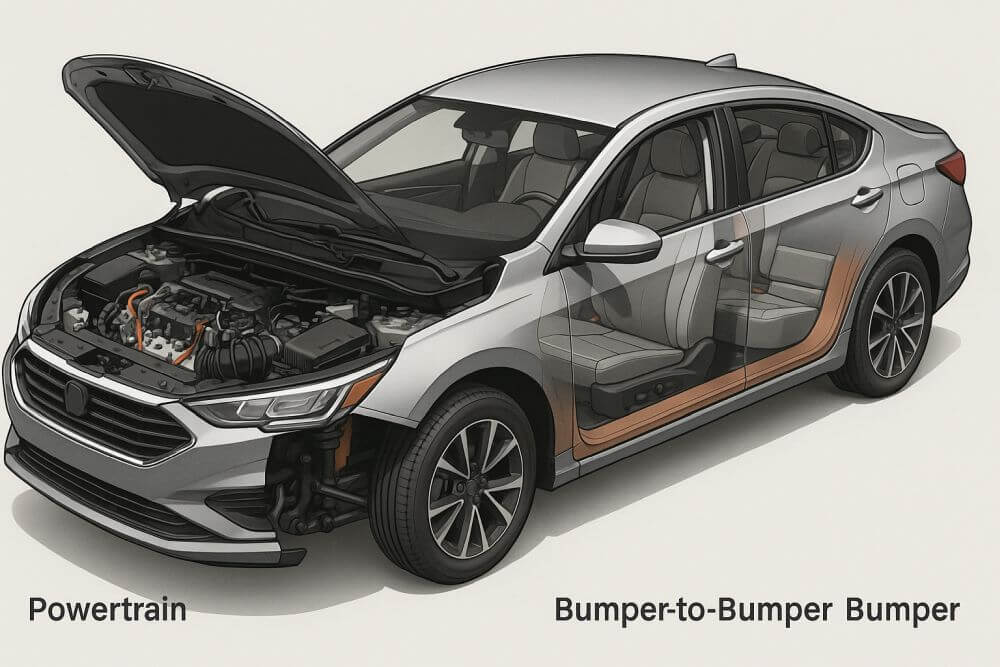

Salvage Title vs. Rebuilt Title – Know the Difference

- Salvage Title – Vehicle has been deemed a total loss and is not legally drivable until repaired and inspected.

- Rebuilt Title – Salvage vehicle has been repaired, passed state safety inspections, and is cleared for road use.

⚠ Even with a rebuilt title, the car’s salvage history stays in the record forever.

Why Cross-Checking Matters

No single database is 100% complete. Some damage may not be reported to insurance (private repair shops, out-of-pocket fixes), meaning it won’t appear in certain reports. Using at least two independent sources—like VinCheckPro and NMVTIS—reduces the chance of missing key information.

When a Salvage Car Might Be Worth Considering

There are rare cases when a salvage car can be a smart buy:

- Project Cars – If you’re rebuilding for personal use and understand the risks.

- Minor Damage Salvage – Cosmetic-only damage (hail dents, light vandalism).

- Parts Donors – Buying for parts rather than road use.

Still, these require in-depth inspections and a clear understanding of resale limitations.

Conclusion – Protect Yourself Before You Buy

A salvage title isn’t always the end of the road for a vehicle, but it’s a critical factor that should shape your buying decision.

Running a free VIN check before purchase can save you thousands of dollars, prevent safety issues, and keep you from falling victim to title fraud.

🚗 Next Step: Want to be 100% sure? Get a Free Carfax Report alternative from VinCheckPro today—it includes title branding, accident history, odometer records, and ownership changes in one easy-to-read report.

Frequently Asked Questions About Salvage Titles

How much cheaper is a salvage title car compared to clean title?

Usually 30–50% less, depending on damage severity and repair quality.

Can I insure a salvage title vehicle?

Some insurers offer limited coverage, but many won’t provide full comprehensive or collision policies.

Can a salvage title be changed to clean?

No. Even if repaired and inspected, the car will have a rebuilt title, and its salvage history remains on record.

Are salvage cars safe?

Some are, if repaired properly and inspected. But many hide serious damage—always get a mechanic’s inspection.

How do I check for a salvage title for free?

Run the VIN through VinCheckPro’s Free Carfax Report alternative and cross-check with NMVTIS and your state DMV.

Do salvage cars qualify for financing?

Rarely. Most banks and credit unions avoid financing salvage-titled cars.

What’s the difference between “flood title” and “salvage title”?

Flood is a specific damage brand under the broader salvage category, indicating water damage.